13

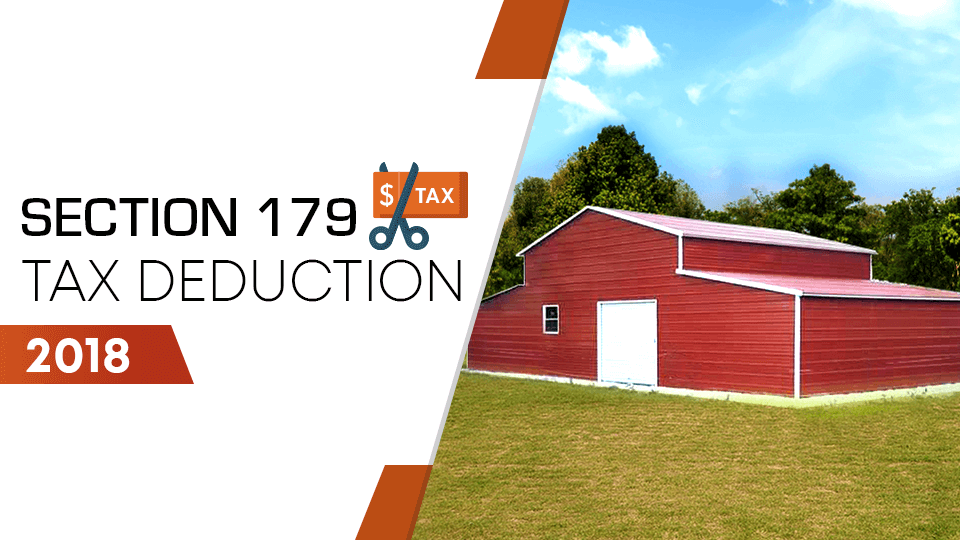

Single-Purpose Agricultural Steel Buildings Qualify for the 2018 Section 179 Tax Deduction!

December 31 is quickly approaching, and for many businesses 2018 has been a profitable year. One thing businesses are always looking for is a legal way to shield their hard-earned profits from taxation; Section 179 tax deductions can help you do just that! This section of the tax code was written to help small businesses that choose to invest in themselves through the purchase of qualifying property or equipment. In 2018, your business can deduct up to $1,000,000 AND have a first-year bonus depreciation of $150,000!

If you’re a farm or business owner, you’re probably aware of the 2017 Tax Cuts and Jobs Act – the biggest tax overhaul since the Tax Reform Act of 1986. Essentially, Section 179 allows businesses to deduct the full purchase price of qualifying equipment or property acquired during the current tax year. This means that if you buy qualifying equipment in 2018, you can deduct the FULL PURCHASE PRICE from your gross business income. It’s an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

The bottom line is simple – investing in your business can provide you with significant tax breaks for 2018!

This has made a big difference for many companies! In years past, when your business bought qualifying equipment, it typically had to be written off a little at a time through depreciation. While that’s certainly better than no write-off at all, most business owners would really prefer to write off the entire equipment purchase price for the year they buy it. Section 179 helps businesses by allowing them to purchase needed equipment right now, instead of waiting. For most small businesses, the cost of qualifying equipment can be written off on their 2018 tax return (up to $1,000,000)!

There are limits to which kinds of property qualify, though. According to the IRS, to count for the current Section 179 deduction the property must be eligible, purchased primarily for business use, and be placed into service in 2018. As a rule, Section 179 applies to certain tangible property and equipment, but doesn’t include real property like buildings and their structural components.

However, if you are a farm or agricultural business owner, there is a category of commercial steel buildings that actually qualify for the Section 179 deduction! IRS Publication 225 explains on pages 39-40 that while most structures don’t qualify, single-purpose agricultural (livestock) or horticultural structures DO qualify for the Section 179 deduction!

So, what are the eligibility requirements for an agricultural structure to qualify for section 179 tax deduction?

To qualify, it need only be used for designated livestock or horticultural purposes. A qualifying single-purpose livestock structure must be designed, constructed, and used to house, raise, and feed a particular type of livestock or poultry. A qualifying single-purpose horticultural structure can be either a greenhouse or facility that is designed, constructed, and used for commercial production of either plants or mushrooms.

As long as the structure is used for one of these listed dedicated purposes, it qualifies! But you need to act now – these special Section 179 tax deductions apply to the 2018 tax year, and there is no guarantee that these deductions will be extended into future tax years. To qualify for the current Section 179 deduction, your structure must be bought, installed, and placed into service during the 2018 calendar year.

Carport Central can help you custom-design, construct, and install a facility tailored to your specific single-purpose livestock or horticultural needs:

- Facility for breeding chickens or any other specific type of poultry

- Facility for breeding hogs, cattle, or any other specific kind of livestock

- Egg production facility

- Dairy production facility

- Commercial greenhouse for plants

- Commercial production facility for mushrooms

- Or whatever else you may need!

At Carport Central, our friendly and knowledgeable building specialists are standing by and are ready to help you get started with a metal building to meet your specific needs. Give us a call at (980) 321-9898 today, and let us help you take advantage of this significant Section 179 business tax break before time runs out!

NOTE: This blog is intended for informational purposes only, and should not be considered as official tax advice. We advise you to consult with your accountant or attorney with specific tax questions or for specific business tax counsel.

Get Started

It's fast and easy. Get your instant quote today!

BLOG TOPICS

- Certified Carports (2)

- COVID-19 (1)

- Prefab Metal Buildings (66)

- Metal Building Homes (6)

- Metal Building of the Week (11)

- Install of the week (1)

- Metal Building Extensions (1)

- Install of the month (2)

- Garages (52)

- Farm Show (1)

- Building Components (1)

- Carports (29)

- Storage Sheds (15)

- Metal Buildings (6)

- Barns (18)

- Metal Homes (8)

- Metal Sheds (1)

- RV Covers (6)

- 12 Gauge Framing (7)

- Workshops (7)

- Eagles & Buildings (1)

- Reviews (2)

- Snowfall in the Southeast (2)

- Carports and Buildings Prices (1)

- Reality Of Discounted Buildings (2)

- Snow Removal (1)

- Offers (3)

- Condensation in Metal Buildings (2)

- News & Awards (12)

- Livestock sheds (4)

- Installations (15)

- Metal Buildings Applications (7)

- Customized Buildings (41)

- Carport Sizes (2)

- Facts (1)

Metal Buildings

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Metal Garages

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Metal Carports

- Alabama

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

- 100x100 Metal Building

- 12x12 Metal Shed

- 12x20 Carport

- 12x24 Carport

- 12x30 Carport

- 16x20 Carport

- 18x20 Carport

- 20x20 Carport

- 20x20 Metal Building

- 20x30 Carport

- 20x30 Metal Building

- 20x40 Carport

- 20x40 Metal Building

- 24x24 Carport

- 24x24 Garage

- 24x30 Carport

- 24x30 Metal Building

- 24x30 Metal Garage

- 24x36 Metal Building

- 26x30 Metal Building

- 30x30 Carport

- 30x30 Garage

- 30x30 Metal Building

- 30x40 Carport

- 30x40 Garage

- 30x40 Metal Building

- 30x40 Storage Building

- 30x50 Metal Building

- 30x60 Metal Building

- 40x100 Metal Building

- 40x40 Metal Building

- 40x60 Metal Building

- 40x80 Metal Building

- 50x100 Metal Building

- 50x50 Metal Building

- 50x80 Metal Building

- 60x100 Metal Building

- 60x120 Steel Building

- 60x60 Metal Building

- 60x80 Metal Building

- 80x100 Metal Building

- All Steel Carports

- American Building Network

- American Custom Carports

- American Steel Carports

- Arkansas Carports

- Best Choice Metal Structures

- California All Steel

- Carports Outlet

- Central Texas Metal Buildings

- Coast To Coast Carports

- Custom Steel Structures

- Dreams Carports and Buildings Inc

- East Coast Carports

- Enterprise Steel Structures

- Infinity Carports

- Interstate Steel Structures

- Long Horn Buildings

- Midwest Steel Carports

- NC Structures

- New Team Carports

- Northside Metal Carports

- Quality Carports

- Rhino Carports

- Safeguard Metal Buildings

- Southern Steel Buildings Inc.

- Steel Buildings and Structures

- Tennessee Steel Buildings

- Tubular Building Systems

- Ultimate Metal Buildings

- United Structures

- USA Carports